The rule was created by Elizabeth Warren, insolvency expert at Harvard University, and her daughter Amelia as a method of effectively taking control of your finances without having to follow a detailed and complex budget or needing to know about economics. It means that you’ll be able to do without non-essential expenses, have savings to fall back on if something unexpected happens, or pay off your debts. Using the 50/30/20 rule as a money-saving method doesn’t mean you have to stop enjoying life, but it does help you to be smart with your money and recognize what areas of your monthly budget are being wasted unnecessarily. The 50/30/20 budget is a way to allocate your after-tax income, it uses 3 principles to do this. It’s a really effective way to balance your income, manage yourself effectively to generate a good amount of savings, avoid wasting money, and reach all of your financial goals.

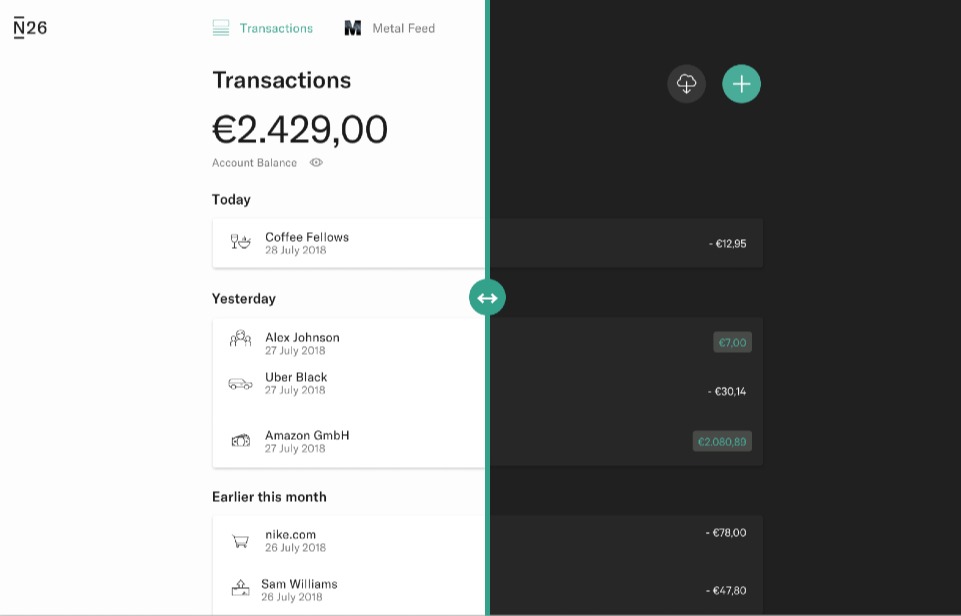

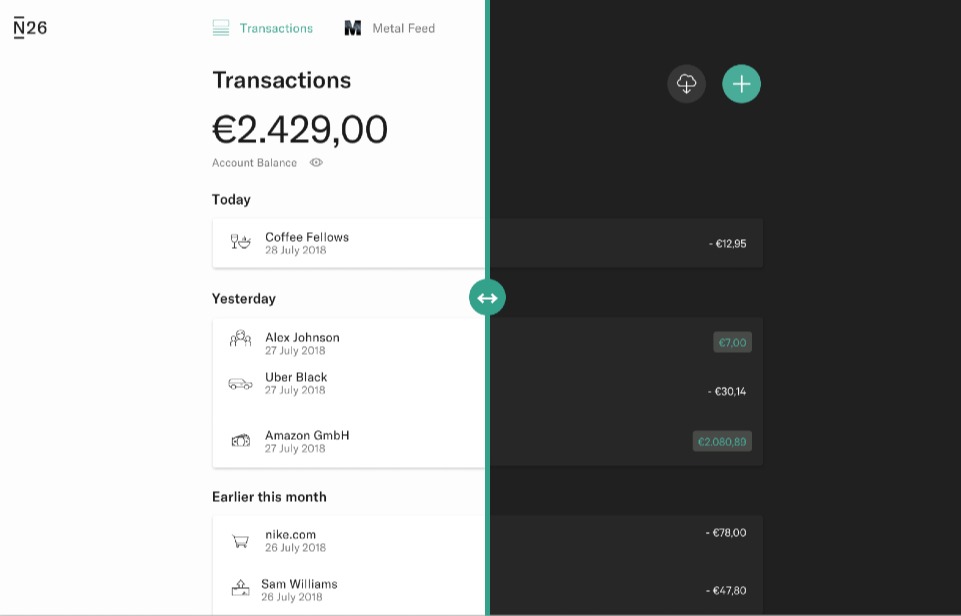

Provides a clear overview of your financesīudgeting calculators provide a clear overview of your finances, including your income, expenses, and savings.īudgeting calculators help you plan for your future by allowing you to save for your financial goals, such as retirement or a down payment for a house.The 50/30/20 rule is a money-saving method that involves allocating certain percentages of your net monthly income to the following three categories: 50% for basic necessities, 30% for disposable income, and 20% for savings and debt payments. Helps you calculate your debt repaymentīudgeting calculators can help you calculate your debt repayment and allocate your income towards debt reduction. Helps you identify areas where you can cut backīudgeting calculators help you identify areas where you can cut back on expenses and save money. They can help you track your expenses, calculate your debt repayment, and save for your future goals.īudgeting calculators simplify the budgeting process by automating calculations and organizing your expenses.īudgeting calculators allow you to set financial goals and allocate your income towards different categories of expenses accordingly. By using the TimelyBills app regularly, you can gain greater control over your finances and achieve your financial goals.īudgeting calculators are online tools that can help you create and manage your budget. Overall, the TimelyBills budgeting calculator is a powerful tool that can help you manage your finances and stay on top of your expenses. In addition, you can use it to track your expenses and income over time and monitor your financial health. Apart from assisting with budgeting, It will also help to create savings goals and track your progress toward those goals. Alternatively, you can also use the budgeting calculator on TimelyBills App. The budgeting calculator will help you stay within your budget by tracking your expenses and reminding you when you are approaching or exceeding your budget limits. Based on your net income, you can then set a budget for each category of expense. The budgeting calculator will then show you your net income, which is your income minus your expenses. Once you have added all your income and expenses, the TimelyBills budgeting calculator will automatically calculate your total income and expenses. You can add multiple income sources and expenses such as rent, utilities, groceries, entertainment, etc. On the budgeting calculator screen, you can enter your income and expenses.

Scroll down to the footer section and click on the Budgeting Calculator.Here are the steps to use the TimelyBills budgeting calculator. TimelyBills is a budgeting app that provides a budgeting calculator to help users manage their finances.

#50 30 20 BUDGET CALCULATOR HOW TO#

How to use the TimelyBills budgeting calculator?

0 kommentar(er)

0 kommentar(er)